Summary

- Implied volatility New Oriental Education remains elevated due to pending reforms to after-school tutoring services.

- Sentiment remains ultra-bearish. EDU has lost $12 a share alone over the past four months.

- The carnage though is all based on “potential” ramifications. Earnings projections continue to rise in EDU.

- We believe the fear is overblown.

New Oriental Education & Technology Group Inc. came across a screen we ran where we were looking for companies trading with high levels of implied volatility (relative to itself) and with a keen valuation.

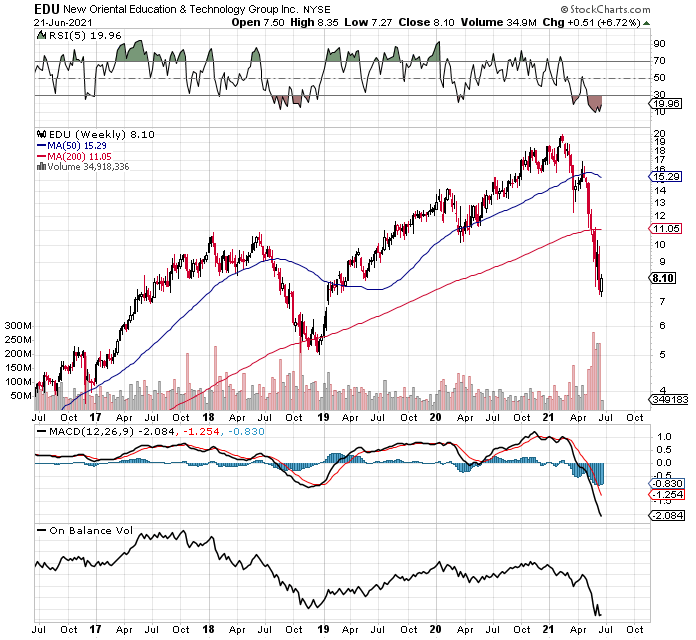

As we can see from the chart below, the company has lost well over 50% of its market-cap since February last year due to elevated fear in the market-place. The boogie-man in this case is the Chinese government which obviously the market believes could ban tutoring for children in out of hour slots such as evenings, weekends or holidays.

While EDU bears may be simply looking at this as a regulation issue, we believe it is more of a cultural one for the following reason. I live in Europe and one of my neighbors is Chinese who has a 10-year-old son. When they came to Europe a few years ago and slowly got to know the school system here, they were shocked at how little their European counterparts studied compared to the Chinese.

My children for example were enjoying their summer holidays one day and the father asked me if my children would be attending tutoring academies during the summer break. In China, he told us that this was the natural course of action for kids and when you see their population, it is not difficult to understand why the competition to get excellent grades is so fierce in that country.

Suffice it to say, withstanding the fear surrounding the potential tighter regulations, this culture of never-ending study to stay ahead of the competition is not going to go away any time soon. Therefore, our first pretence would be to sell the elevated fear through the use of put options to put long-deltas to work in here.

Before doing that though, let’s take a look at EDU’s valuation along with its growth rates and profitability to see if we can get a handle on what sort of downside risk is in play in EDU going forward.

Firstly, with respect to valuation, EDU’s book multiple presently comes in at 2.8 and its sales multiple comes in at 3.4. These multiples have obviously taken a huge hit this year. EDU’s five-year averages for example come in at 6.7 & 5.7 respectively for both book and sales so the company’s assets in particular have taken a beating in this downturn (down 58% in value).

Is it warranted though is the question? Many bears will most likely say yes as the industry trades at 3.46 & 1.43 respectively for both assets and sales. Suffice it to say, despite EDU’S ugly downturn over the past four months or so, we acknowledge that its sales for example are still more expensive than the industry average.

However, when we look closer at EDU’s metrics, we see a company with superior growth and profitability which explains to a certain degree why the stock was more expensive than the industry before the decline started. Top-line sales in EDU are growing twice as fast as the industry and grew by a staggering 29% in the firm’s latest quarter with K-12 after-school tutoring leading the way.

We see the same outperformance in EDU’s profitability metrics with the company reporting 52%+ gross margin and net income margin of more than 10%. Suffice it to say, EDU’s numbers are well above the average firm in this space which why the smart bet here is that EDU will continue to take share from its competitors.

We state this because there has been no deterioration (over the past 60 days) with respect to bottom-line estimates for both this year and next year ($0.29 & $0.44 respectively) but yet shares have lost half their value since this time in April. Furthermore, it was clearly evident in the company’s recent Q3 earnings call that EDU has formed an attitude of being ultra-nimble and responsive with respect to the trading conditions they encounter.

We have already seen this with respect to the success of the company’s OMO (online-merge-offline) system when Covid-19 hit and we believe the firm will most definitely have planned out contingencies concerning any potential decision from the Chinese government regarding regulation. In fact, (as we see in many markets), regulation many times results in the bigger companies taking significant share from smaller players due to the latter not being able to compete in the new system.

Therefore, to sum up, we do not see demand drying up for any of the programs EDU offers as education has become ingrained in the culture. We will most likely see a change in how programs are administered but as mentioned this should suit the bigger players. EDU is still growing much faster than the industry and its valuation from an assets standpoint has not been this cheap since 2014. Its net profit incidentally has doubled within this timeframe. We look forward to continued coverage.

Source: Seeking Alpha