Summary

- NIO’s Q3 deliveries fall below guidance midpoint.

- Despite new models, September barely showed any growth.

- Analyst estimates for NIO stock continue to decline.

Over the last year, one of the companies I’ve been most frustrated with is NIO. The Chinese electric vehicle maker has seemingly had an issue every quarter that has significantly impacted its growth plans, at a time when the EV market is increasing rapidly. Over the weekend, the company released its Q3 delivery results, with the result being another round of disappointment.

For the quarter, NIO delivered 31,607 vehicles, representing growth of nearly 30% year over year. While that is a quarterly record and seems like solid growth, it was only about three weeks before the quarter’s end that the company reported its Q2 results. At that time, management was calling for 31,000 to 33,000 deliveries, so the actual Q3 number fell more than a bit short of the midpoint of that range.

With July and August numbers already known when Q2 results were reported, September’s 10,878 deliveries thus fell short of the month’s guidance as well. This is extremely disappointing because it represents just 2.4% growth over September 2021. This is despite two new models, although one of which only recently started deliveries, but also the fact that we are more than 18 months removed from an agreement for its partner facility to double production capacity to 20,000 units a month. NIO is also building out its own factory that’s supposed to reach volume production in the next couple of months. It certainly will need to get production going quickly to compete with the likes of BYD and Tesla, the latter of which is producing over 2,000 vehicles a day at its Shanghai factory alone.

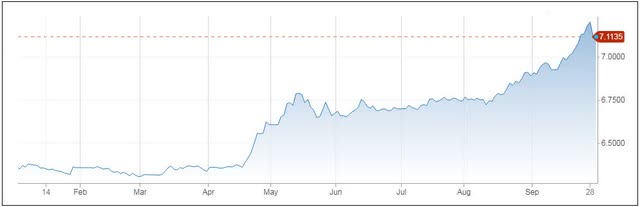

About two months ago, I covered what I considered to be NIO’s first disappointment during Q3 with its July delivery results. At that time, and for most of the summer, street analysts were looking for the company to report almost $6 billion in revenues in the second half of this year. Since then, estimates have been cut almost continuously, going into this weekend’s news at just over $5 billion. With NIO missing the midpoint of guidance, we could see more estimate cuts, and it doesn’t help that the US dollar has surged against the Yuan as seen below. That will pressure revenues when translated into US dollars at the Q3 earnings report.

Interestingly enough, September wasn’t even NIO’s best month for total deliveries. It actually tied for second with November of 2021, despite that month having fewer models for sale and the fact that the partner facility has been upgraded since. As a reminder, the company’s goal was to deliver 100,000 vehicles in the second half of this year, which is going to require very significant improvement in Q4. NIO hasn’t topped 13,000 deliveries in any month of its history so far, but one would figure it will certainly have to do that during each month this quarter (and be well above that level in November and December) to have any real shot at the second half goal.

When looking at NIO shares, they’ve been dragged down with the overall market recently. As the chart below shows, it has not been a great year for the stock, which is only a few dollars away from its 52-week low. At the moment, both the 50-day moving average (purple line) and 200-day (orange line) are on the decline, which could provide resistance on any move higher. Since my previous article, the average street price target has come down by about $3, now sitting just above $30. While that certainly implies significant upside from here, just remember that the street’s average valuation entering this year was $60, and we know how that’s turned out.

In the end, September’s delivery result was another disappointment for NIO investors. Despite giving guidance with only about 3 weeks to go in the quarter, the company didn’t even hit the midpoint of its delivery range. Year-over-year growth for the month was minimal, despite new models and supposed production ramps. Barring much better execution rather soon, NIO looks like it will miss its back half of the year growth target, perhaps by a significant margin. With analyst estimates likely to continue a bit lower, it’s hard to see this stock moving much higher until this growth story finally materializes, unless the name is dragged higher if the equity market soars.

Author: Bill Maurer, Seeking Alpha