Summary

- GreenTree Hospitality Group has seen a sharp price drop of late.

- In spite of the risks, I take the view that the current sell-off is overdone at this time.

- I anticipate that the stock will recover from here.

Investment Thesis

In spite of the risks, I anticipate that GreenTree Hospitality Group is oversold at this point and could rebound to a target price range of $15-21.

In a previous article back in May, I made the argument that while GreenTree Hospitality Group (GHG) has made a strong recovery in the past year, competition is set to increase as the broader hospitality industry also recovers.

Recent Performance

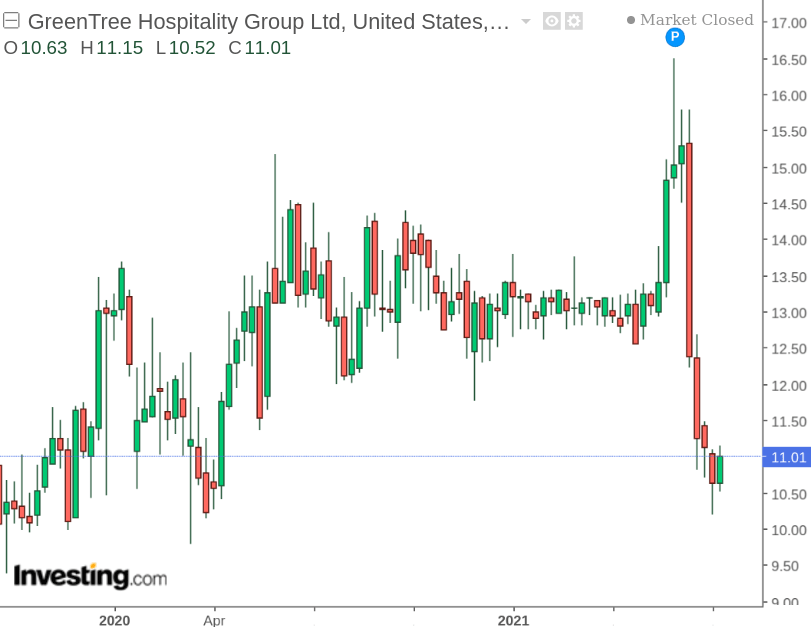

Recently, we see that price has been very volatile, with the stock consolidating at a price of $11.01 at the time of writing.

Source: investing.com

The reason for this sharp drop is somewhat unclear, and could reflect profit-taking on the part of many investors. GreenTree Hospitality Group (and the Chinese hotel industry more broadly) took less of a hit than their European and American counterparts due to the COVID-19 pandemic. That said, with clear signs of a recovery in hotel booking demand across the U.S. and Europe, it could well be the case that investors see limited upside for the stock from here and are taking profits at this point.

However, the financials of GreenTree Hospitality Group have been quite impressive considering the pressures posed by the pandemic. The company has significantly increased its cash on hand throughout the pandemic to meet short-term expenses, while also continuing to expand its operations to meet rising occupancy rates.

Valuation

From this standpoint, I make the argument that GreenTree Hospitality Group is likely to be undervalued at this point, and significant upside could be ahead assuming that earnings growth continues to remain solid.

When looking at the fiscal year results from 2018 to 2020, GreenTree Hospitality Group continued to see positive net earnings in 2020, even though the same had fallen sharply from the previous year.

| 2018 | 2019 | 2020 |

| 0.58 | 0.62 | 0.39 |

Source: GreenTree Hospitality Group Fourth Quarter and Fiscal Year Results (2018 – 2020)

From this standpoint, I make a five-year target price forecast using the following assumptions:

- EPS will rebound to the 2018 level of $0.58 this year, as the hospitality industry across China has not been affected by closures to the extent seen across the United States and Europe. I am then forecasting a moderate growth scenario of 10% per year and a high-growth scenario of 20% per year.

- The terminal P/E ratio is assumed to be 25x, as I anticipate that investor enthusiasm will moderate over the longer term as the broader market stops “betting” on hotel stocks as a recovery play.

Source: ycharts.com

- The discount rate is assumed to be 7%, as a proxy for the assumed long-term rate of return on the S&P 500.

- The target price is calculated as the product of the terminal P/E ratio and the present value of diluted EPS in year 5.

10% growth scenario

Source: Author’s Calculations

20% growth scenario

Source: Author’s Calculations

Under the 10% and 20% growth scenarios, we see that significant upside for GreenTree Hospitality Group is still indicated – with a target price ranging from $15 to $21.

Risks

With the company set to report its first quarter results on July 28, this will provide a good indication as to whether GreenTree is on track to meet my predicted EPS for the 2021 financial year.

While I am optimistic that this will be the case – risks undoubtedly remain – especially given the fact that GreenTree Hospitality Group operates in an emerging market within what is a volatile industry at this time. Therefore, price may continue to be volatile and may not necessarily reflect earnings performance, particularly in the shorter term.

From an industry standpoint, Western competitors such as Hilton (NYSE:HLT) and Hyatt (NYSE:H) are now seeing a strong recovery across the United States and Europe – and could be in a better position to continue expanding throughout China as compared to 2020 – when the focus was on cash preservation.

Additionally, as international travel starts to rebound – we could start to see a pattern where increasing numbers of Chinese customers start to travel abroad again. This could be somewhat of a detriment to GreenTree, as customers who would have made a hotel booking domestically during the pandemic will now opt for an international booking instead. The pace at which this can be expected to happen remains unclear, but it is a risk factor and competition within the domestic Chinese market will invariably increase as Western competitors start to recover.

Conclusion

When weighing up the risks and potential growth opportunities, I take the view that GreenTree Hospitality Group stands to see significant upside from the current price.

The recent sell-off appears to be overdone, and in spite of increasing competition, hotel booking demand across China continues to remain vibrant. Based on the assumptions I have outlined above, even a relatively moderate earnings growth rate of 10% per year would be expected to yield significant upside for the stock. For this reason, I take a bullish view on GreenTree Hospitality Group.

Author: Discount Fountain, Seeking Alpha