Summary

- US and Chinese regulators have finally struck an agreement that allows for the audit inspections of Chinese stocks.

- But even with the agreement in place, the delisting risk still persists for Alibaba and other such impacted firms.

- Risk-averse investors may want to avoid the stock for the time being.

There’s been a lot of furor surrounding Alibaba of late. Chinese and US regulators have finally reached an agreement last week under which the former will allow the latter to conduct unfettered audit inspections of several hundred Chinese companies. This development reduces the outright delisting risk for US-listed Chinese companies such as Alibaba, but investors shouldn’t celebrate too soon. Specifically speaking, the agreement doesn’t solve the underlying issues and Alibaba may still be faced with the delisting risk in the US. Let’s take a closer look to gain a better understanding of it all.

Reasons to Cheer

Let me give a brief background for the uninitiated. There was an accounting fraud at a Chinese company called Luckin Coffee back in 2020. The company was listed on US exchanges and US-based investors lost their capital due to the scandal. So, in order to prevent such mishaps from happening again and to protect the interests of its citizens, US regulators instated the Holding Foreign Companies Accountable Act (or HFCAA) along with its underlying framework that would require foreign companies to open their books to audit inspections, or risk getting delisted by 2024.

The SEC published several provisional lists over the course of the past year, enlisting non-compliant Chinese companies such as Alibaba that were at risk of getting delisted in the US. There was only one problem – the Chinese government was not complying. See, Alibaba or its auditor, on their own, did not have the freedom or authority to open up to audit inspections from US regulators and had to first seek approval from the Chinese government. From its last 20F filing:

PricewaterhouseCoopers, our auditor, is required under U.S. law to undergo regular inspections by the PCAOB. However, without approval from the Chinese government authorities, the PCAOB is currently unable to conduct inspections of the audit work and practices of PCAOB-registered audit firms within the PRC on a basis comparable to other non-U.S. jurisdictions. Since we have substantial operations in the PRC, our auditor and its audit work are currently not fully inspected by the PCAOB, and as such, investors of our ADSs, Shares and/or other securities do not have the benefit of such inspections.

But in what’s being hailed as a landmark deal, Chinese regulators have finally allowed audit inspections by the Public Company Accounting Oversight Board (or PCAOB) of the US. The goal is to comply with the SEC’s listing requirements and prevent mass delisting of Chinese stocks from US bourses especially during these times of macroeconomic turmoil. But don’t bet the farm on Alibaba just yet. While this agreement is a good start and a welcome news, there’s still a lot of ground to cover to eliminate the delisting risk for Alibaba and other such impacted Chinese stocks.

Delisting Risk Still Persists

There are broadly three arguments to be made here. First, Alibaba and JD.com will be amongst the first Chinese companies that will be inspected by US regulators in September. There isn’t any precedent on how strictly does PCAOB conduct its audit inspections on Chinese companies. If the inspections are politically motivated, then the US regulators are likely to highlight all possible accounting irregularities regardless of their scale or magnitude. But if US regulators are just looking to ensure that the broad strokes of GAAP accounting standards are being followed, then the inspections are likely to be lenient and rather uneventful. Only time will tell what gets unearthed in these inspections.

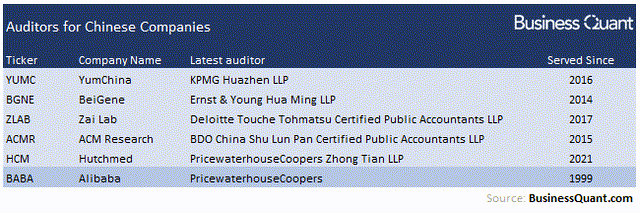

Secondly, one might speculate that Alibaba’s auditor is globally-renowned PricewaterhouseCoopers so US regulators will surely go easy with their inspections on the company. But that’s not necessarily a given. Many other Chinese companies that made it to SEC’s provisional lists of potential delisting, have reputed Big Four auditors, yet they’re in the same boat with Alibaba. So, I think it’s best to not assume anything at least until the inspections begin.

Third, we don’t yet know what kind of turbulence will these inspections unleash. For instance, will the accounting irregularities, if any, be as huge as Alibaba overstating active users, or as minor as misrepresenting petty cash. Also, will the PCAOB issue a written request to Alibaba, asking it to address the accounting discrepancies, or will that notification be backed by a yet another delisting threat. Depending on the findings and the scale of discrepancies, Alibaba and other similarly impacted firms may also be asked to restate their financials.

The point that I’m trying to make here is that only the audit inspections will reveal the true size and scale of accounting irregularities, if any. Without knowing the outcome of these inspections, we cannot rule out the delisting risk for Alibaba and other similarly impacted Chinese stocks. Let’s remember that Chinese and US regulators have only agreed to conduct audit inspections so far, but that in itself doesn’t address the issue of following US GAAP accounting standards. If anything, this is the time when accounting irregularities are likely to show up and market panic may ensue.

Investors Takeaway

It’s worth noting that Alibaba’s shares are currently trading at just 2.1-times its trailing twelve-month sales. This is quite low by industry standards, especially when compared to some of the other rapidly growing e-commerce companies. So, the stock does seem to be undervalued, at least according to this parameter.

But it’s important to understand that the delisting risk still persists for Alibaba. Only the PCAOB inspections will reveal whether Alibaba is in accordance with the US GAAP accounting standards or if it has to restate its financials. So, I believe the stock is basically a gamble at this point, that can swing in either direction in the coming weeks.

With that in mind, risk averse investors who don’t have the appetite for portfolio drawdowns and are prioritizing capital preservation, may want to avoid the stock for the time being at least. However, contrarian investors with a far greater risk appetite and tolerance for volatility, may want to consider accumulating the stock while it’s still seemingly undervalued. Good Luck!

Author: Business Quant, Seeking Alpha