Alibaba: Time To Be A Contrarian

Summary

- SEC de-listing news has no material impact to Alibaba as it is not any new news and should have been priced in.

- Alibaba’s multi-platform growth strategy is helping the drive the e-commerce penetration and improve user penetration.

- Cloud revenues of Alibaba will in the future be more diversified and have less reliance on internet sectors.

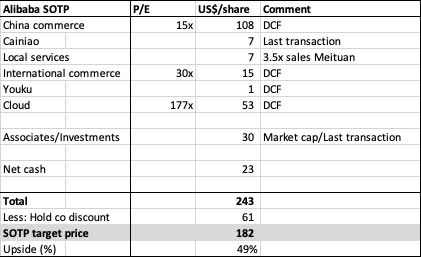

- I derived a target price of $182, implying a significant margin of safety and an upside potential of 96% from current levels.

I have written an earlier article on Alibaba, since then, the stock has been doing rather poorly with it being down 18%. This was further aggravated by a sell off in Chinese ADRs on Thursday, which I will explain further below.

Investment thesis

That said, I am starting to really like the risk reward of Alibaba from here and as such, list out my investment thesis as shown below:

1. China commerce: One of the most valuable assets Alibaba has is its huge consumer base of 950 million users and spends $1,300 annually, which can bring about further monetisation or help scale its other newer platforms.

2. International commerce: This business is a low hanging fruit for Alibaba as it has a replicable strategy and strong moat, as well as logistics capabilities to compete with international e-commerce brands in international markets.

3. Cloud: Alibaba will likely remain the leader in a fast growing cloud market in China and continue to look out for international markets to grow in. Furthermore, its in-house production of chips and development of OS could bring about further cost efficiencies and better products while reducing reliance on third party suppliers.

4. Investing for growth in the future: Alibaba is reinvesting its incremental profits into its strategic businesses which, in my view, is necessary to ensure Alibaba is able to compete and win competitors. Also, Alibaba is continuing its mergers and acquisitions strategy to acquire new businesses to capture future opportunities or bring value to existing businesses.

What happened

During Thursday US trading hours, we saw a very broad based sell off in Chinese Internet ADRs, ranging from 8% to almost 20%. This, I believe was due to worsening investor sentiment in Chinese ADRs in general due to the US SEC website updates on the provisional list of issuers identified under the Holding Foreign Companies Accountable Act (HFCAA).

Specifically, the US SEC website updated the provisional list of issuers identified, including BeiGene, Yum China, Zai Lab, ACM Research, and HUTCHMED China, according to the Holding Foreign Companies Accountable Act (HFCAA).

Under the HFCAA, the Public Company Accounting Oversight Board (PCAOB) is responsible to determine whether it is unable to inspect or investigate completely a registered public accounting firm or a branch or office of such a firm because of a position taken by an authority in a foreign jurisdiction. The Commission’s role at this stage of the process is solely to identify issuers that have used such PCAOB-identified public accounting firms to audit their financial statements. The date provisionally identified was Mar 8 2022 and the date by which the issuer may submit evidence disputing identification is Mar 29 2022

In addition, on 11 March 00:30 Asia time, the China Securities Regulatory Commission responded to an inquiry by a reporter. It commented on its website that it believes the SEC updates are a normal procedure following the HFCAA. The CSRC emphasized that it respects overseas regulatory bodies’ efforts to strengthen regulations on related accounting firms to improve listing company financial information quality, but the CSRC is strongly against some parties politicizing securities regulations. The CSRC will insist on openness and cooperation, and is willing to solve related investigations of U.S. regulatory departments on accounting firms through regulatory cooperation.

It also said that Chinese regulators have been communicating with the Public Company Accounting Oversight Board (PCAOB) recently with positive progress. The CSRC believes that through cooperative efforts, both parties will rule on arrangements that are compliant with law and regulatory requirements of the two countries, to protect global investors and support healthy and stable development of the two countries’ markets

Thus, I am of the opinion that the SEC update is actually not new news and there is no real risk of ADRs de-listing in the near term but rather, this will only be a 2024 to 2025 issue if companies fails to disclose the requirement mandated by the SEC for three consecutive years.

Furthermore, for issuers like Alibaba, they are required to provide certain additional disclosures in their annual report filing starting from the reporting period of the fiscal year 2022. This means the cut off date is when companies file their 2022 annual report, which will be by 30 April 2023. And only if companies fail to disclose the requirement for three consecutive filings (2022-2024 annual report) will they no longer be complaint with the requirement set by the SEC. That said, it seems that legislation might be advancing in the US Congress that could shorten the three-year grace period to two years.

As such, this is a good buying opportunity for large cap ADRs that already have dual listing in Hong Kong like Alibaba

Multi-platform growth strategy

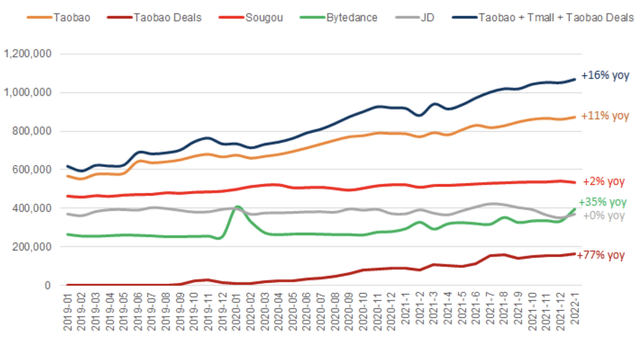

When looking into Alibaba’s 3QFY22 results, I am of the opinion that we are seeing that the key strategic investments under the company’s multi-platform growth strategy is helping Alibaba to further expand its user penetration, especially so in less developed rural areas.

First, with Taobao Deals, it has achieved a total of 280 million annual active consumers (AAC), which was up almost 39 million quarter on quarter, while the paid orders on Taobao Deals grew strongly at over 100% year over year.

Second, with Taocaicai, the community marketplace business grew GMV by 30% quarter over quarter. Based on the comments by Alibaba’s management, the unit economics per order of Taocaicai continued to improve. This was due to higher regional order density and improving gross profit margins from enhanced supply chain capabilities.

Third, Alibaba continues to execute towards building a highly digitalized supply chain and fulfillment to capture the diversified demand within its 979 million AAC in China, with 1) 30 minutes to 1 hour delivery through Ele.me, Freshippo & Taoxianda; 2) same day/next day delivery of groceries through Tmall Supermarket powered by Cainiao; and 3) next day delivery to community pick-up points through community marketplace model (CMP) for value-for money cohorts in lower-tier cities.

Diversified growth in cloud

Although cloud competing revenues was Rmb19.5 billion, which was up 20% year on year, this is compared to the 33% and 50% year on year performance a quarter and a year ago. The slowdown was mainly caused by the effect of Bytedance’s decision to stop using Alicloud overseas cloud services for its international business and slowing demand from customers from the Internet vertical like online entertainment, education and game. The business was partially supported by growth from financial and telecommunication industries.

If we were to exclude revenues from Bytedance, cloud computing revenue has grown by 29% year on year. While it seems like Alibaba’s cloud revenue observed the slowest pace of growth, I am of the opinion that we are seeing the cloud business move gradually towards a more diversified revenue stream. What this means is that the contribution from non-Internet industries will increase steadily to 52% of Alibaba’s cloud revenue. On the other side of things, industrial digitalization will require massive amounts of computing power and thus there is a need to leverage powerful data intelligence capabilities, and this is where are Alicloud excels in.

Valuation

Based on my earlier article, I have created a financial model for Alibaba Group, using rather conservative forecasts, in my view. I applied a holding company discount of 25%, with other assumptions in the table below. Based on the SOTP valuation, I have derived a target price of $182 for Alibaba, implying a 96% upside from current levels.

Again, I emphasise that this is based on conservative numbers and there are many others that model more optimistic numbers but I prefer to have some margin of safety on my numbers.

Summary

Alibaba is currently trading on very negative sentiment not only with regulatory uncertainty in China and the recent SEC de-listing news. However, I am of the opinion that now is the time to be the contrarian investor for Alibaba as the downside is rather limited and thus there is a huge margin of safety for the stock.

Author: Simple Investing, Seeking Alpha