Summary

- Besides PetroChina’s debt, the pandemic and the shift to electric vehicles bring obvious risks.

- However, Petro is trading at an ultra-low valuation and has been growing its cash flows significantly.

- We see little downside risk here as long as sizing is kept in check.

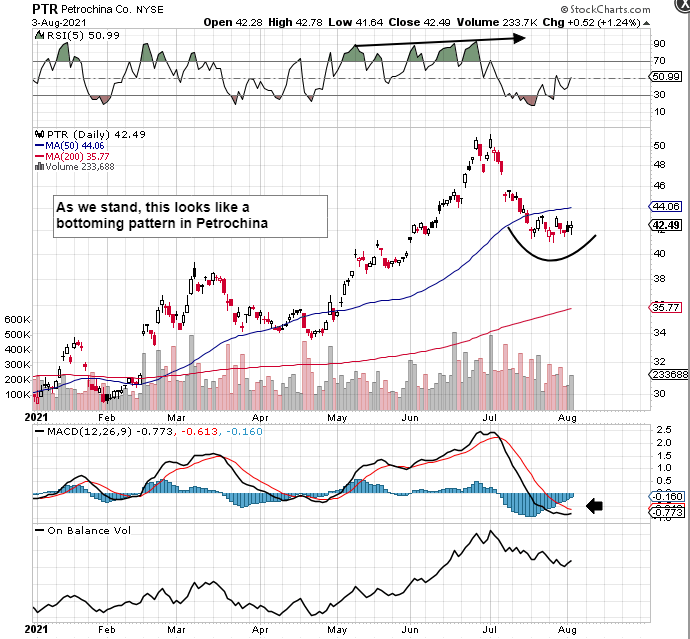

If one takes a look at the daily chart of PetroChina (NYSE:PTR), shares have lost close to $8 a share or 16% since printing those $50+ highs on the 1st of July last. It is fair to say that the delta variant of the coronavirus is the most likely instigator of this latest down move. As a result of the down-move, shares are very close to giving a buy signal on the popular MACD indicator. This indicator is used a lot on large-cap stocks (where history repeats in the majority of cases) as it is a solid read on both momentum and trend of the respective stock. The momentum shares demonstrated as they rallied into that July 1st top indicates to me that a sustained down move has not begun here.

Whether new variants of the coronavirus are going to cause more lockdowns this year and subsequently put pressure on energy markets remains to be seen. That is the first risk I see over the near term with respect to investing in PTR. An additional long-term preoccupation with investors is the whole uncertainty surrounding how the oil industry will be shaped in years to come.

Although PetroChina has earmarked most of its future investments for natural gas projects, it is still heavily exposed to oil operations and carbon. In fact, given the nature of its extensive upstream operations, any sizeable decrease in the price of the commodity is going to affect its earnings and most likely share price adversely.

Given the fact though that inflation will have to rear its ugly head sooner rather than later (which will help commodities), I am not as pessimistic on energy plays and the whole sustainability argument in energy. The reason being that if the likes of solar power as well as electric vehicles gain significant traction over the next few years, oil (through mining as well as parts) will continue to be required on mass to bring these technologies to market in a significant way.

If indeed I am wrong and the above market-based risks gain traction, then Petro’s balance sheet would come more into the equation. The reason being is that the company’s liabilities surpassed $172 billion in the most recent quarter. Any sizeable reduction in Petro’s net-worth (with its current level of debt) would mean creditors would look differently at this firm.

Petro’s current ratio of 0.96 (although improving) demonstrates how little of the firm’s equity is made up of current assets. Bulls would state though that the company’s liquidity numbers were far worse at the end of fiscal 2019, but shares still managed to finally bottom last year and enjoy an aggressive rally up to July of 2021.

This is why, as alluded to above, one must invest in essentially what is in front of them. The first area is profitability. Whereas many will zone in on the ultra-low forward GAAP multiple of 6, Petro’s trailing operating cash flow of $51.11 billion means the company’s price to cash flow ratio comes in an ultra-low 1.5.

The $50+ billion number ensures that the company can continue to be aggressive with respect to its investments with the excess cash protecting against some type of unforeseen event. Furthermore, based off 2021 fiscal earnings projections ($7+ in EPS), these trends should ease investor’s minds with respect to the company’s debt load.

In fact, considering Petro’s significant cash flows, the dividend yield (which currently tops 6%) looks rock solid at present. Despite $26+ billion going towards investing activities over the past four quarters, Petro’s cash dividend payout ratio comes in at a very healthy 28%. Suffice it to say, Petro’s dividend safety as well as the dividend yield are significantly better than what this sector is offering at present to investors.

Suffice it to say, we would expect some type of mean-reversion event to take place with respect to the company’s valuation over time. With Petro’s cash flow, assets, sales and earnings all selling well below their long-term averages, the cash flow cycle is in place to keep on growing the company.

Therefore, to sum up, although risks undoubtedly exist in PetroChina, one needs to invest in what is in from of them. With Petro, one has the possibility to invest in a growing dividend-paying company which currently trades at a very keen valuation. Let’s see if the MACD buy signal can come to fruition. We look forward to continued coverage.

Author: Individual Trader, Seeking Alpha