Summary

- China Online Education has reached profitability over the last four quarters when China started with the lockdown.

- Covid was a catalyst for higher revenues rather than a one-time occurrence, as revenue kept growing in Q1/2021.

- The operating business model was severely pressured, starting one month ago. The Chinese government proposed regulation which will impact the EdTech sector.

- I believe the market is overreacting though. China Online Education is now trading cheaper than its cash and short-term investments. This provides a value opportunity.

- However, risks have to be taken seriously, as the competition in the market remains fierce and the uncertainty regarding governmental regulation is high.

Investment Thesis

The shares of China Online Education (NYSE:COE) are highly distressed from regulatory pressure. They plummeted ~70% during the last year. I regard this selloff as an opportunity to start a small investment position, as the long-term organic demand for English lessons will probably grow. The company has strong gross margins and ~50% of its expenses derive from marketing costs. Because of strong operating cash flows and the possibility to quickly cut costs, I believe the company is not threatened by a small- to medium-term drawback in revenues. Over the long run, the pullback from venture capital sources for EdTech companies in China will likely lead to less competition.

Stats and projections not linked to directly, are obtained from the financial reports of China Online Education or the financial reports and investor relations of 51Talk. You can get hold of all data in the latest annual and quarterly filing of China Online Education or on the website of 51Talk respectively. In terms of currency conversion: 1 USD = 6,46 RMB.

Business Model

China Online Education derives ~92% of its revenues from the website: 51talk.com. 51Talk is a leading online education platform in China. Primary focus is one-on-one English teaching. The remaining 8% of revenues are derived from other English teaching services: Hawo (4%) and Worry-Free English (4%). In 2020, 95.1% of the active students were K-12 students, meaning students from kindergarten to 12th grade.

I will focus more extensively on the business of 51Talk since the other two services are similar to it and of low impact for the company. First, the article will center on the organic business model and in a second part on the future risks posed by new regulations of the Chinese government.

Revenues and Earnings

Revenues of China Online Education are primarily driven by an increase in the number of paying students. The company divides in active and paying students. Paying students have purchased a course package. Active students have booked at least one paid lesson in the period reported.

From 2018 to 2019 paying students rose from 169,600 to 172,000 – a mere increase of 1.4%. During this time, numbers of active students rose from 310,000 to 351,000. An increase of 13.2%. Revenues were climbing 29% from 177 million USD to 229 million USD. The increase of revenue was attributed to an increase in the number of paid lessons booked, driven by an increase in the number of active students. The company states that the market expansion into lower-tier cities in China had significant impact.

From 2019 to 2020, things looked different. Because of the lockdown in China, parents were booking more online classes for their children to keep up with their English education. Numbers of paying students rose from 172,000 to 263,200 – an increase of 53%. The number of active students rose 34% from 351,000 to 470,700.

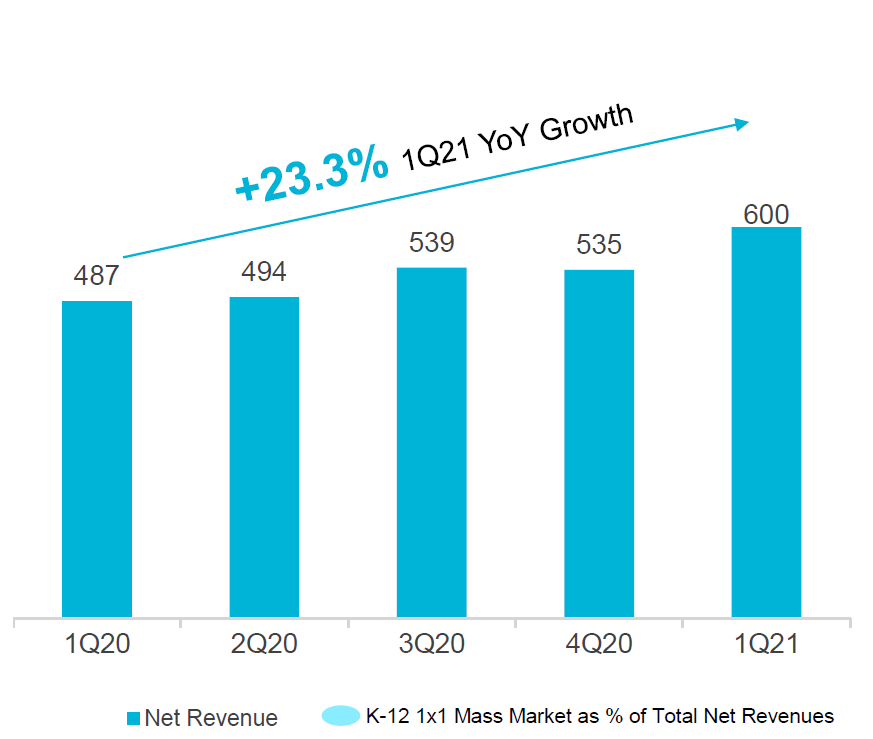

Revenues in 2020 were up ~39% from 229 million USD to 318 million USD. It’s important to note that even as the lockdown in China eased, revenues continued to climb. It seems like Covid was more of a catalyst rather than a one-time occurrence. In Q1/2021 revenues were advancing, reaching 93 million USD. That’s an increase of 23% compared to Q1/2020 when the lockdown in China started.

(Source: 51talk.com)

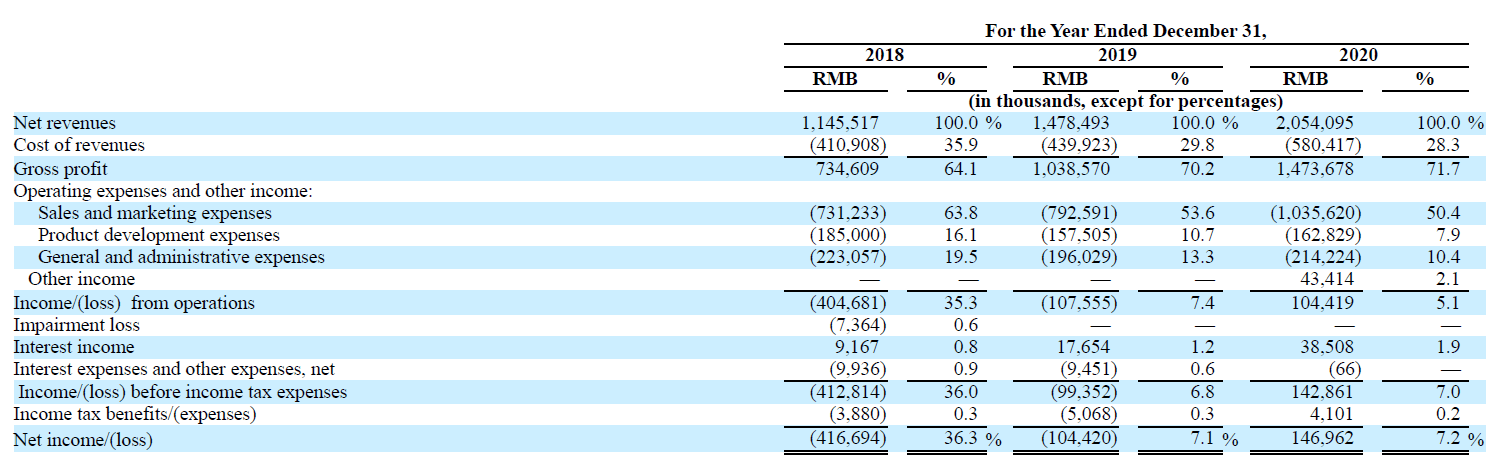

The company is employing Filipinos for its English lessons to teach Chinese kids. According to 51Talk, their Filipino teachers have native-level English proficiency. Because of this business model, wage disparities can be used to the company’s advantage. The total amount of service fees paid to teachers for delivering paid lessons was 84 million USD in 2020. These 84 million USD make up the majority of the costs of revenues. Total costs of revenues amount 90 million USD in 2020. Revenues in 2020 were 318 million USD. Therefore, the gross margin was at ~72%. Gross Margin in Q1/2021 was even higher at 73,4%. 51Talk is paying about ~2 USD per lesson to its teachers, while revenues per lesson are ~8 USD. The organic business is highly profitable.

Sales & marketing expenses for China Online Education group were diminishing returns in 2020, amounting to 155 million USD. That’s 53.6% of revenues. However, I expect free trial lesson related expenses to play a huge part here. But the annual report shows no further separation. Together with service fees for teachers, administrative and development expenses, the operating income decreased to 16 million USD, representing an EBIT margin of ~5,1%. 2020 was the first profitable year for the company.

(Source: 20-F filing of China Online Education)

I believe the EBIT margin has huge upside due to the fact that ~50% of revenues are spent on marketing. Marketing expenses are divided in online & offline marketing and free trial lessons. The company is on a growth path, which is why these huge expenses are justifiable. Competition originates from Yuanfudao backed by Tencent (OTCPK:TCEHY), Zuoyebang from Alibaba (BABA) and other big names such as TAL Education Group (TAL), New Oriental Education (EDU) and Gaotu Techedu (GOTU).

China Online Education operates in a niche business but is nonetheless required to actively compete for students. Especially because the business has a limited number of recurring revenues: Either students improve their English and have no need for further English lessons or they don’t and most likely cancel the classes.

If the growth phase of the company is finished, slowing marketing expenses in combination with the huge gross margin could lead to stellar EBIT margins and net income. But realistically, with the current fragmentation of the EdTech sector in China, the switch from “growth- to return-mode” could take years. The key takeaway is that marketing expenses are usually flexible. If additional cash is needed, China Online Education can quickly adjust their expenses and generate more excess cash from its operating business to cover.

Cash Flows

Operating cash flows rose significantly from 2018 to 2020. Net cash provided by operating activities was 4.6 million USD in 2018. In 2019 operating cash flows were 62 million USD and 2020 had another significant increase of ~81% to 111 million USD of operating cashflows.

The strong results in 2020 were mainly driven by an increase of 83 million USD of advances from students. The company attributes this increase to the business growth along with the market expansion into lower-tier cities in China during 2020.

Cash flows from investing activities were -114 million USD. Around 108 million USD were spent on short-term investments, which seems rational because of the huge cash flows from student advances during the same period.

Value Opportunity and Liquidity

Current liabilities of China Online Education are 465.5 million USD. A vast majority of 421.3 million USD are non-monetary liabilities in the form of advances from students. That leaves 44.3 million USD of monetary current liabilities and 9.2 million USD of non-current liabilities. Comparing the monetary debt with the operating cashflows analyzed above, shows the strong liquidity of the company. Cash flow-to-debt-ratio was ~2.07 in 2020.

Furthermore, cash, time deposits and short-term investments account for ~186 million USD. That exceeds the market cap of ~164 million USD. Due to the recent selloff, the market expects the company’s business model to be highly unprofitable. In other words: With an investment of 1 USD in China Online Education you’ll get ~1.13 USD in cash & equivalents and the ‘burden’ that these assets are integrated in the operating business. A business, which saw strong organic growth and reached profitability in the last year. The market thinks the business will be severely impacted by the new regulation of the Chinese government.

Regulation of Online Tutoring

In March 2021 Xi Jinping signaled that the after-school tutoring was putting immense pressure on China’s kids. This led to warnings and penalties aimed at predatory practices from EdTech businesses. After-school tutoring is popular in China, especially as preparation for the “Gaokao”, which represents the National College Entrance Examination. Many Chinese Parents are paying huge sums for after-school tutoring in order for their children to earn a spot in one of the top-tier universities. This is one of the reasons the K-12 EdTech market has been booming. Regulators are saying that some firms are exploiting parental paranoia with false ads and misleading campaigns.

In early May 2021, Chinese regulators imposed penalties on Zuoyebang (Alibaba) and Yuanfudao (Tencent) for unfair competition and misleading advertising. In June 2021, the Ministry of Education created a dedicated division to oversee after-school education and tutoring. This was followed by plenty of restrictions, including caps on fees, time limits on after-school programs and even a ban on tutoring for primary school-level lessons to pre-schoolers.

Starting from March 2021, EdTech stocks in China tanked, due to a continuous stream of news on regulatory pressure:

(Orange: Gaotu Techedu, yellow: China Online Education, black: TAL Education Group, green: New Oriental Education)

(Source: tradingview.com)

The stream of negative news could continue, as there has been speculation that a law specifically regulating tutoring could be coming. According to International analyst Vivien Chain the worst-case scenario for the industry is the following: After-school tutors might be banned from operating on weekends and holidays, their prime hours. The existing guidelines already forbid tutoring activities linked to test-taking and enrollment admission.

A Contrarian’s Thoughts

I believe the new Chinese regulations will impact the EdTech sector in the short and medium term. However, I don’t believe the EdTech sector will be impacted severely in the long term. This was the projected market size of online education in China until 2024, before the new regulations were public:

(Source: statista.com)

There’s no doubt that these projections are not realistic anymore. There will be a significant bump during 2021, and recovery will probably start in 2022. But the cause and therefore the driving factor for online tutoring demand still exists: Good results in the ‘Gaokao’ are highly desirable and can elevate future income and job chances of Chinese children significantly. The organic demand for K-12 English lessons from China Online Education will stay as long as the school and job landscape in China remains as competitive as it is now.

(Source: Bloomberg.com)

Venture capital funding for EdTech startups is plummeting. Bloomberg projects a decrease of ~80% in 2021. I believe this is a double-edged sword: It will impact China Online Education in the medium term. The company cannot collect as much capital through share issuance, because of low share prices. But less venture capital also means less competition for already existing companies. This should be beneficial to China Online Education.

Furthermore, the focus on English lessons is an advantage, as it provides an important market for children. To this day, many Chinese adults have little to no English-speaking skills. With China’s economy rising, fluent English skills will be of importance for workers of tomorrow and will create advantages in the labor market – parents know that. According to China Online Education, children in Chinese schools are trimmed to study English in order to pass tests, not to hold conversations fluently.

Usable English skills are the goal of China Online Education, not only pursuing good grades. The proficiency trend of English speaking people in China is already showing positive tendencies during the last few years. The business model of China Online Education seems to be fitting the narrative of a growing English-speaking population.

With the great liquidity, flexibility and cash flows, China Online Education can survive a potential setback in revenues which could originate from the new regulations of the Chinese government. The valuation of the company is incredibly distressed and priced for an even worse scenario as the worst-case scenario. China Online Education is a small-cap company, operating in a fast-growing market and the price is even cheaper than its cash & short-term investments.

Risks

China Online Education is a Chinese small-cap stock. There’s a long history of fraudulent Chinese companies. This is why investors have to be cautious. 51Talk.com has fitting traffic for its business from China & the Philippines. There are plentiful reviews from employees on social media. The company has been listed on the NYSE since 2016 and the short interest of the stock is 1.74%. I’d say the chances of being a fraud are very limited.

However, China Online Education is still a Chinese small-cap stock! Recently, the US government threatened to delist Chinese companies from US stock exchanges because of the lack of compliance with US auditors. A delisting from the NYSE would reduce liquidity of the stock and most certainly provide downside pressure. There are significant political risks involved in Chinese stocks, as tensions between the USA and China continue to rise. The momentum of Chinese stocks during the last months is bearish. This affects China Online Education and could lead to even more downside.

There’s huge uncertainty regarding the new regulations proposed by the Chinese government. The regulation could turn out to be even stricter than the worst-case scenario proposed in the article. Revenues of China Online Education could be severely impacted. If students cancel their already paid lessons, liabilities in the form of advances from students will have to be settled via paybacks, rather than service. There’s a chance that the business, even with its huge gross margin and cash flows could not survive due to the potentially overly oppressive regulations. I regard the chances of this happening as miniscule, though.

Conclusion

I believe this is the right time to start adding for a small investment position in China Online Education. The stock price has been overly distressed because investors panic-sold the continuous stream of negative news. The organic demand for English lessons in China will most likely increase in the long run. Because of strong operating cash flows and the possibility to quickly cut costs, I believe the company is unthreatened by a small to medium-term drawback in revenues.

Author: Nikolai Galozi, Seeking Alpha