Summary

- For Chinese stocks, the tough macro backdrop last week was just another flesh wound on a badly battered body with multiple lacerations.

- The overly exploited VIE risk continued to be effective in spooking the market, with an unsubstantiated Bloomberg report on a China ban making the rounds many times over.

- A SEC statement on the lack of access to audit papers in China reignited fears over the delisting of Chinese ADRs.

- The strong cash position of JOYY pushing it to potentially see a negative enterprise value exemplifies the undervaluation Chinese stocks are experiencing.

- My portfolio is deep in the red but I am more ashamed of being adamant about how wrong the naysayers were. I’m sorry for pushing in vain the weekly narrative that has been supportive of Chinese stocks.

There were numerous developments for global investors to digest last week, causing the stock markets to be more volatile than usual. Commentaries regarding the Omicron COVID-19 variant continued to fly in from various quarters, from medical professions to economists.

The ensuing uncertainties over the impact on the economy led to energy prices weakening dramatically, turning inflation concern on its head. Yet, the Federal Reserve reiterated hawkish talks of faster tapering and reaffirming speculations of earlier-than-anticipated hikes in the interest rates.

Worries that an accelerated rise in the cost of capital would exacerbate the operating losses of a big basket of non-profitable growth stocks escalated over the week. Disappointing outlook amid a weak earnings season and stiffer competition facing several so-called stay-at-home/work-from-home stocks like DocuSign, Zoom Video Communications, and Robinhood worsened the bearish sentiment.

For Chinese stocks, the tough macro backdrop last week was just another flesh wound on a badly battered body with multiple lacerations. However, specific developments, which I will elaborate on in this article, can be said to be the straw that broke the camel’s back.

In the past week, the Xtrackers Harvest CSI 300 China A-Shares ETF appeared to be living on another planet. The ASHR ETF climb 1.5 percent even as the other representative ETFs of Chinese companies and their U.S. counterparts ended in the negative.

The oasis of calm in the ASHR ETF can be attributed to its diversified sectorial portfolio, in addition to having stocks entirely from the A-share market in mainland China. The embattled information technology sector represented only 14.6 percent of the ASHR ETF as of September 30, 2021.

Source: DWS Group

The stocks in the ASHR ETF were also unaffected by the oft-repeated delisting risk and the much-feared use of the Variable Interest Entity [VIE] structure adopted by certain Chinese companies to list in offshore markets. This distinction is important as renewed trepidation over the two issues sent the Invesco China Technology ETF tumbling 7.3 percent for the week while the iShares China Large-Cap ETF sank 3.5 percent.

Eight of the ten top holdings of the are Chinese internet-related stocks. For four of these, the ETF is holding their U.S.-listed American Depository Receipts [ADRs], even though three have secondary listings in Hong Kong – Baidu, Bilibili, and GDS Holdings.

In contrast, six of the top ten holdings of the FXI ETF are Chinese internet stocks and it is the Hong Kong shares that the ETF is holding for all of them. The FXI ETF doesn’t have any ADRs. On the other hand, ADRs represented 23.7 percent of the entire CQQQ portfolio as of December 2, 2021.

Furthermore, although the FXI ETF owns the dreaded Alibaba shares and the CQQQ doesn’t, the latter is overwhelmingly exposed to the heavily scrutinized Information Technology sector (46.7 percent of the CQQQ ETF portfolio versus 5.2 percent for the FXI ETF) as well as the Communication Services sector (40.1 percent of the CQQQ ETF portfolio versus 19.1 percent for the FXI ETF).

Chinese internet stocks have become indefensible

Following the change in tide after the IPO suspension of Ant Group, the fintech unit of Alibaba Group, I have diligently attacked the fallacies in bearish arguments and pointed out the silver linings from the regulatory crackdowns on the Chinese internet companies. It has been over a year since, and while there were some rebounds along the way, they turned out to be false dawns.

In the past two years, we have seen the Chinese ETFs climbed to a crescendo in February and rolled downhill thereafter. Up until June, the KraneShares CSI China Internet ETF, the internet sector representative ETF, and the CQQQ ETF were neck-to-neck on the way up, as well as on the way down too.

From June, the underperformance of the KWEB ETF became more pronounced and stayed that way since. Three main drivers of the unabated selling of Chinese internet stocks are as mentioned earlier – i) a heightened regulatory environment, ii) delisting concerns, and iii) fears of a potential repudiation of VIEs by the Chinese government resulting in the Chinese ADRs losing all their value overnight.

Each wave of the regulatory crackdown was deemed as an unrelentless attack on the entire private sector

The bulk of the regulatory actions required of Alibaba Group can be said to be made known along with the penalty meted out for its past transgressions in April. Unfortunately, the authorities shifted their attention from e-commerce to the other sectors, seemingly leaving no stones unturned in their quest to rein in the previously freewheeling internet companies.

Each wave of the regulatory crackdown was deemed as an unrelentless attack on the entire private sector. This was so even when the authorities communicated the rationale and the purpose was isolated to a specific industry, like after-school tutoring.

While businesses like Tencent Holdings would experience collateral damages from the decline in advertising revenue and losses from its investments into the education startups, the impact on Alibaba Group is minimal. That had not stopped shareholders from dumping BABA shares on this development.

Likewise, following a regulatory probe into Meituan’s monopolistic practices and an undercover expose of the dire working conditions of its delivery personnel in May, BABA shares were dragged down along with Meituan. This was strange as Meituan is the main rival of Alibaba’s local services business group Ele.me and Koubei.

Both Ele.me and Koubei would also face higher labor costs from an improvement in compensation for their delivery workers. However, instead of benefiting from the regulatory spotlight shifting to others, BABA shares behaved like the cloud and e-commerce giant was the one being investigated instead.

Besides some paltry fines imposed on a few Chinese internet companies including Alibaba last month, Alibaba hasn’t been a target of regulatory actions for months. This appeared to be lost on the market, with BABA continuing on its downtrend.

The overly exploited VIE risk continued to be effective in spooking the market

This was perhaps due to a reinvigorated ‘campaign’ by the bear camp to emphasize the risks related to the VIE structure used by Alibaba and the other Chinese tech companies that enabled them to seek offshore listings. My attempt in August, and others after me, assessing the risk level and determining it was more fear-mongering than a real threat, failed to assuage concerns.

A Bloomberg report that surfaced mid-week saying China was planning to block companies from going public overseas via the VIE structure sent investor anxiety to a climax. The headline implied it was a fact and “news” but the article body clarified the possible move was “according to people familiar with the matter.”

Source: Bloomberg

China Securities Regulatory Commission [CSRC], the relevant authority on this matter, denied the story, asserting that Bloomberg’s report was “not true.” Unfortunately for shareholders, the horse had left the barn. Other media outlets rushed to repeat the ban as though it was the gospel truth.

“Sell first and ask questions later,” the advice goes. Even as the ‘answers’ came, the selling accelerated. Marcia Ellis, global chair of the private equity group at law firm Morrison and Foerster, was quoted by SCMP as saying “[I]t is clear from the history of government regulations and pronouncements regarding the VIE structure from the last five years that a sudden ban of all overseas listings of companies using the structure is unlikely.”

Recently, the CSRC had even approved a listing by artificial-intelligence [AI] company Megvii Technology in Shanghai and a listing by streaming music platform Cloud Village in Hong Kong. Both Megvii and Cloud Village adopted VIE structures for their public offerings.

Would the CSRC have given the green light for the IPOs if there are plans to ban the use of VIEs? Unlikely so. Importantly, the same SCMP article also revealed that its sources disclosed the Chinese government intended to continue supporting mainland Chinese companies in raising funds overseas.

Beijing is often accused of arbitrary and brash directives. However, any final decision would be a result of months-long consultations with “leading investment bankers, accountants and lawyers on VIEs,” sources told SCMP.

Given the extensive coverage of Bloomberg’s VIE ban story, it can be gleaned that Bloomberg’s “people familiar with the matter” were deemed much more authoritative than SCMP’s. The latter is a Hong Kong-based news agency with offices in mainland China but its report on Beijing’s support for Chinese companies in seeking funds overseas was not propagated by other media.

Respected Chinese financial media publication Caixin reported that the Chinese regulators had indeed been crafting new regulatory measures on VIE structures recently. This suggests that Beijing is working on formalizing VIEs, rather than intending to enact a blanket prohibition.

The truth doesn’t matter to a market seemingly void of sense and in a state of panic. It doesn’t help that we are in the final window for tax-loss selling. There were speculations that fund managers could re-enter BABA, TCEHY, MPNGF, etc. when the stocks rebounded so that they can boast to have astutely ‘caught the bottom.’ Such hopes have most likely crumbled with sentiment this bearish and only four weeks left for the final quarter of the year.

Reignited fears over the delisting of Chinese ADRs

Disregarding potential accusations of opportunism, the Securities and Exchange Commission [SEC] on Thursday announced its final plan for putting in place a new law that mandates foreign companies provide access to U.S. inspectors of their books or risk being kicked off the New York Stock Exchange and Nasdaq. Scores of Chinese ADRs plunged on the news.

Talks on delisting Chinese stocks gained traction after the U.S. Senate started the ball rolling by passing the bill for the Holding Foreign Companies Accountable Act [HFCAA] in May last year. The implementation of the HFCAA is very arduous and as we have seen, despite nearly two years passed since the idea was mooted, the SEC has not even begun identifying companies that may not comply with the audit inspection requirements, the first step in the new rule.

The drawn-out process was cited by bulls to challenge the immediate sell-offs at each step of the delisting plan. Furthermore, any exit would be after three years of non-compliance. However, shareholders didn’t care. There may be a hundred steps to the eventual booting out and there will be selling at each point. There is no such thing as ‘priced in’ if history is any indication.

This is so even as the same Bloomberg article reporting on the SEC move acknowledged that a top official at the CSRC revealed the regulator was “working very hard” to resolve the audit oversight issues with its U.S. counterparts, a development Reuters covered on November 25.

Source: Bloomberg

Some investors may have assumed what is happening to DiDi Global would apply to the other Chinese internet companies like Alibaba Group, JD.com, Full Truck Alliance, and Pinduoduo. Their shares tumbled on Friday, extending the losses from the two adverse events mentioned earlier.

Recall that DiDi bulldozed its way to its IPO despite indications that the Chinese government remained hesitant in the run-up to its public debut. Other tech companies did not brazenly defy the authorities. It doesn’t matter to investors though.

The market reaction to DiDi’s plan to delist from the New York Stock Exchange, ostensibly due to a directive by the Cyberspace Administration of China, implied this: if one Chinese company gets disciplined, it is assumed that all Chinese companies will suffer the same fate.

I am sorry

Bulls are exhausted fighting the tide. My energy defending Chinese stocks is spent. Week after week, I laid out both the positive and negative developments, explaining why the market was wrong about the latter. However, the ‘voting machine’ mode is stuck and the ‘weighing machine’ mode did not get turned on after more than a year.

My portfolio is deep in the red but I am more ashamed of being adamant about how wrong the naysayers were. I don’t know if I have been influential enough to sway any readers but I’m sorry for pushing the weekly narrative that has been supportive of Chinese stocks.

Over the past year, whenever my knees turned weak on each steep drop experienced by BABA and my other holdings, the ‘lessons’ of the past ‘told’ me to stay the course. I shared in a comment in the previous Chinese Internet Weekly [CIW] that I had covered Chipotle in the past and encountered strong skepticism the fast-food chain could recover from its food safety.

The following comment from my August 23, 2017 article is akin to a condensed version of the hundreds of comments on CIW ridiculing my arguments against the bearish calls on BABA and the other internet stocks that I regularly write about.

CMG stock took well over a year before recording a new record high. I eventually sold before the share price hit the $600 mark as I absorbed the bear arguments and decided to take profit. Missing out on the big gains thereafter left a deep impression on me.

A greater lesson came from selling Crocs too early. This, and other episodes, left me ingrained that I should stay the course with stocks that experience unjustified market pessimism.

I now painfully realized that BABA is no CMG or CROX. Bearish headlines on Alibaba Group attract millions of eyeballs. Chipotle or Crocs? Hundreds of thousands at best, logically speaking. The hits from the media are going to keep coming furiously. Sentiment could stay bearish for much longer.

Furthermore, the revulsion towards investing in Chinese stocks was much more overwhelming than I had anticipated. Famed investor Ray Dalio was blasted in a tweet by Mitt Romney on Thursday for his investments in China. The Republican senator from Utah had no qualms denigrating someone he deemed “brilliant” and “a friend.” What kindness do I expect of readers who do not know me, a nobody, personally? Nonetheless, I would be lying if I tell you the disparaging comments that I received all these while did not affect my mood.

Ironically, that has led me to be more diligent in ‘exposing the FUD’ and sharing my findings on CIW. I read voraciously the reputable industry publications and check out the official government sources directly instead of relying on the media articles.

The process increased my conviction to my misfortune, as my investments soured and my reputation as a financial writer is going down the drain, if there is any left. More dishearteningly is the knowledge that there are many BABA bulls here that are painfully holding like I am.

It is no consolation to know that the downtrend in BABA is tracking many of the much-ballyhooed tech stocks in the U.S. This is especially so if you are also holding on to these names in the charts like I am with Teladoc Health, Zoom Video Communications, and Schrodinger.

Fundamentals don’t matter anymore for Chinese stocks

We have come to a point where fundamentals don’t mean much to the valuations the Chinese stocks deserve. SA reader Jeremy94 made a valiant attempt at elucidating the bull camp’s various supporting drivers in a comment last week. I encourage critics and shareholders alike to read for yourself the well-articulated thoughts.

One of his many brilliant pointers was “If all this FUD wasn’t happening, you would never be able to buy these money making, cash flow positive companies at [their] current prices.” Unfortunately, the adage ‘the market can stay irrational longer than you can stay solvent’ rings loudly.

For investors that don’t use leverage, staying solvent is not difficult. However, we have the opportunity cost to consider. Shareholders of JOYY Inc should know this very well. The operator of social media platforms such as Bigo Live and Likee enjoyed a market capitalization of around $12 billion in February, only to lose much of that to trade at a four-year low of $3.2 billion.

JOYY’s net cash, meanwhile, has ballooned to $3.6 billion this year. Consequently, its enterprise value [EV] has shrunk from over $9 billion to a mere $134 million. Soon, it could even have a negative EV.

Data by YCharts

Data by YCharts

In a sign that market players acknowledged YY stock was undervalued, shares surged in August following a Reuters report saying that the company’s top shareholders were working on a take-private plan that would value the social-media platform developer at $8 billion, 2.5 times higher than the prevailing market cap. However, JOYY subsequently denied it received any formal takeover offers.

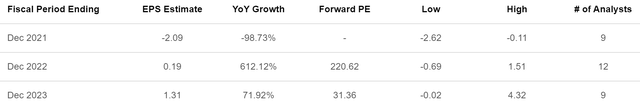

JOYY is trading at a forward price-to-sales ratio of 1.2 times for FY2021 and 0.9 times for FY2023. The forward price-to-earnings ratio could shrink to a mere 31 times based on consensus projections for FY2023.

Source: Seeking Alpha Premium

This would have been a screaming bargain if JOYY is not a company with the bulk of its operations and assets in China. Besides country-specific issues, JOYY has also been accused of fraud by famed short-selling outfit Muddy Waters which is helmed by Carson Block.

I explained why the accusations by Muddy Waters on JOYY might be built on malice, a genuine lack of understanding of the industry, or plain denial due to sunk cost in an article in November last year titled Baidu Is Not GM, JOYY Is Not Nikola. Unfortunately, at the risk of being repetitive, I have to say short-sellers can say whatever they want now and the market could believe hook, line, and sinker, with sentiment so bearish.

Chinese stocks have become the proverbial post-apocalyptic zombies that living humans run away from, as far as they can. ‘Once bitten, twice shy’ is an understatement for many who have tried catching the falling knives of Chinese stocks this year.

As explained in a past issue of the Chinese Internet Weekly, I found the KWEB ETF holding the most representative stocks in the sector. As such, an overview of the week’s share price movements of the top ten holdings of KWEB (as of Friday) compared with the ETF itself is provided as follows for convenient reference especially for the stocks mentioned in this article.

Author: ALT Perspective, Seeking Alpha

Data by YCharts